When someone says ‘Challenger Bank’, you imagine a mobile-first legacy-killer, an upstart start-up that’s out to steal the lunch from all the traditional players in town. They come in various flavours, but are segment specific, catering to SME, or Lending, or CASA; some might have a fashionably disproportionate focus on lifestyle banking.

All this requires a high degree of adaptability. Which means APIs and extensive partnership networks.

If we took this chain of thought further, we could reasonably conclude that Digital Challenger Banks are completely exclusive from conventional players. That they are a first world phenomenon.

Right?

Not quite.

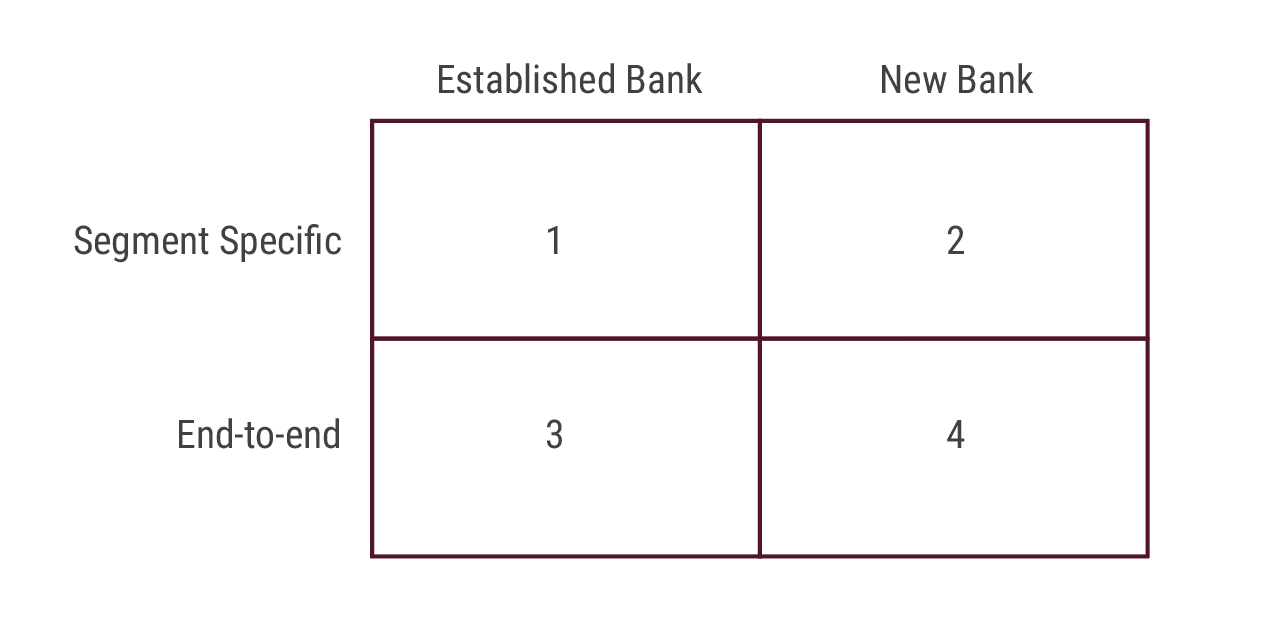

Take a look at the quadrants below.

Which quadrant would you imagine a Challenger Bank would fit in?

Which quadrant would you imagine a Challenger Bank would fit in?

The answer is ‘all of the above’.

And here’s the big reveal: Challenger Banking is an attitude, not an institution.

Irrespective of size, geographic location or stage of maturity, any bank can adopt and successfully carry off a Challenger Banking mind-set. While it might seem counter-intuitive, this phenomenon is rather more widespread than you imagine. If you are convinced this is a first world phenomenon, let’s look at the other end of the spectrum.

Welcome to Africa

On the one side, we have cheaper technology, the shrinking presence of global banks and the removal of several services from non-core markets like Africa (as a consequence of the 2008 crisis). On the other, we have a very mobile friendly population that’s tasted technology and is hungry for banking on the go.

Africa is fertile for Challenger Banking. To get going, simple pieces – payments, fund transfers, savings, salary account, along with card management, will do. Local monoliths slow to adapt to this are losing out to a new rush of challengers capitalising on the opportunity. They don’t need to be too big, and need to have a hold over a particular segment or two.

So now we’ve established that geography doesn’t have a say in in the Challenger Banking phenomenon. What about size? After all, these are competitors to the establishment, adaptive players who can move faster than the legacy technology of the conventional players. Before soothsayers begin to prophesise the end of universal banking, the local banks have begun to adapt.

It’s an Attitude

With a strong connect to the Central Bank, a large existing customer base, and an obvious demand for a particular service, local banks have begun to go digital in strategic bits.

Instead of getting into a complete overhaul of their technology, they create and deploy a Challenger Bank under their own umbrella. Not enough SME focus? No problem, corral a business + ops + tech team to run a challenger module.

The inherent modular structure of open banking and API banking has freed legacy banks from the pressure of a complete one-time overhaul. They can now focus on progressive modernisation without losing out on emerging opportunities in the market.

A new end-to-end Digital Challenger Bank might try to stir the pot, but an existing bank which want to go Digital has the bigger opportunity here.

To reiterate, irrespective of which quadrant a bank falls under, all it needs to leapfrog legacy and capture opportunity is a challenger mind-set. How can one capture that mind-set? How do you find out if you have that mind-set? Here’s one way to find out.

Litmus test for the Challenger Banking Mind-set

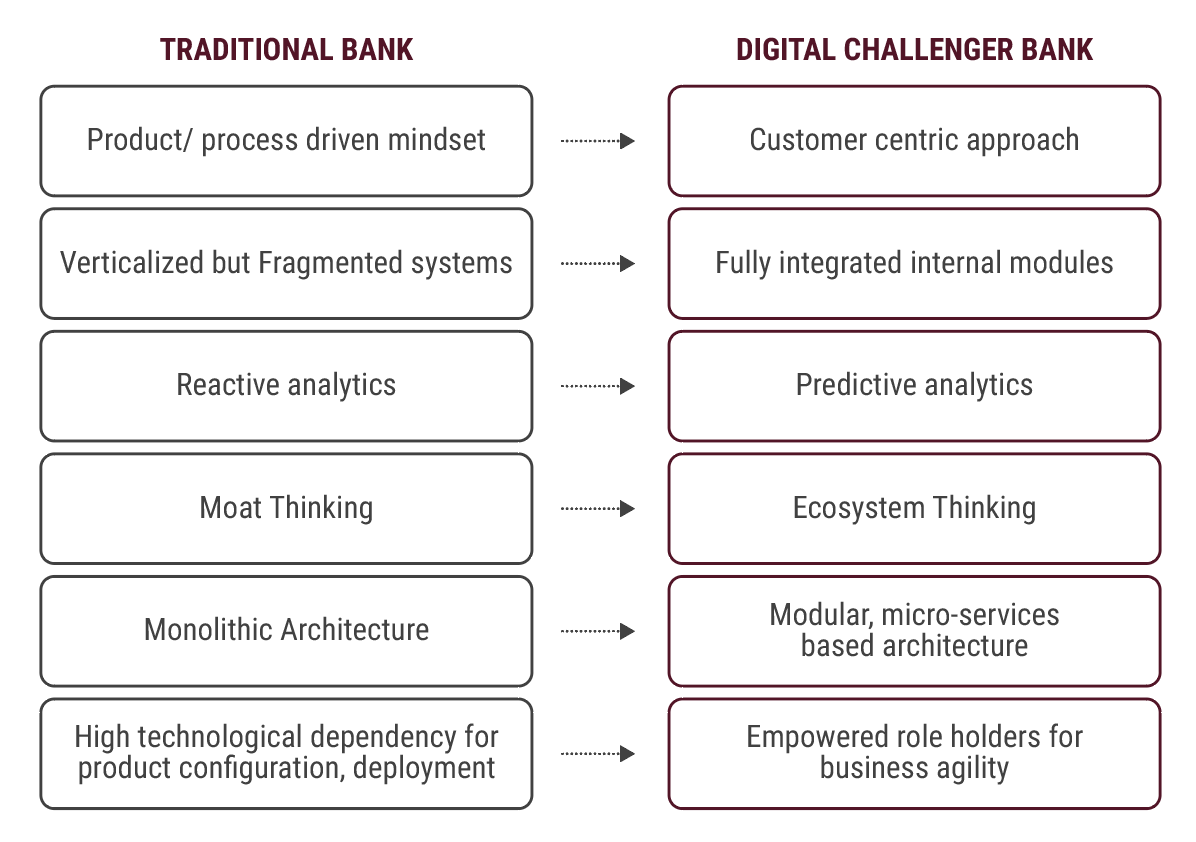

We believe there are six key arcs that constitute the shift in attitude from an traditional bank to a challenger bank. Feel free to evaluate yourself along these facets. You may even choose to look at this shift as a spectrum and gauge how far along you are on the journey.

In the next blog, we delve a little deeper into the challenger mindset, examine these arcs, and attempt to answer the question – how viable is all of this?

In the next blog, we delve a little deeper into the challenger mindset, examine these arcs, and attempt to answer the question – how viable is all of this?