Last Twelve Months Revenue Stood at INR 3025 Cr, reflecting 23% YoY growth

EBITDA reached INR 709 Cr with a 33% YoY growth

Intellect Launches World’s Only AI-First Payments Platform to the U.S. Market

Chennai (India), January 30, 2026: Intellect Design Arena Ltd, a global leader in AI-First, enterprise-grade financial technology, architected from first principles and powered by Design Thinking to deliver measurable business impact at scale, today announced its third-quarter results for FY26.

I. Intellect Brings World’s Only AI-First Payments Platform to US Market as Payment Revolution Accelerates

As part of the US market expansion, Intellect launches the world’s only AI-first payments platform, architected from first principles for business impact. As a purpose-built low-code/no-code composable framework, the platform enables institutions to move beyond incremental upgrades and design payments systems that deliver speed, resilience, and competitive advantage at scale. It allows them to rapidly deploy new payment rails and scale real-time payment capabilities with speed and operational certainty.

AI First Unified Orchestration Across US Payment Rails

- Single AI-powered orchestration layer across TCH RTP, FedNow, ACH, Fedwire and SWIFT

- Purple Fabric AI operates before, during and after transactions for real-time validation, anomaly detection and exception handling

- Built on eMACH.ai and Pay9 architecture, enabling modernisation without core replacement

Strengthening Intellect’s US Market Commitment

- Expanded US footprint with New York headquarters, Atlanta operations centre and Austin AI hub

- 2 million annual R&D hours across New York and Toronto

- Strategic acquisition of Central 1 digital banking operations and growing US partnerships reinforce long-term commitment to the US wholesale banking market

II. Financial Performance

Last Twelve Months (LTM) – Financial Highlights

Income:

- Total income stood at INR 3025 Cr as against INR 2457 Cr in LTM Q3FY25 – grew 23% YoY

Platform, License and AMC Revenue:

- Platform revenue is INR 497Cr as against INR 218 Cr in LTM Q3FY25 – grew 128% YoY

- License Revenue is INR 540 Cr as against INR 462 Cr in LTM Q3FY25 – grew 17% YoY

- AMC Revenue is INR 559 Cr as against INR 482 Cr in LTM Q3FY25 – grew 16% YoY

- License-linked revenue (License + Platform + AMC) is INR 1595 Cr as against INR 1163 Cr in LTM Q3FY25 – grew 37% YoY

- Annual Recurring Revenue (ARR) is at INR 1118 Cr as against INR 700 Cr in LTM Q3FY25 – grew 60% YoY

EBITDA and PAT

- EBITDA is INR 709 Cr as against INR 534 Cr in LTM Q3FY25 – grew 33% YoY

- Profit After Tax is INR 361 Cr after considering exceptional item on gratuity for INR 31 Cr pursuant to new labour codes as against INR 283 Cr in LTM Q3FY25 – grew 27% YoY

Collections

- Collections for LTM Q3FY26 are INR 2964 Cr as against INR 2229 Cr in LTM Q3FY25

Deal Wins and Digital Transformations

- 53 new customers have chosen Intellect’s Digital Stack for their digital transformation in the last twelve months

- Digital Transformations (Go-Lives): 82 global financial institutions have transformed their digital journey on Intellect platforms and products

Leadership Announcements

- 27 Leaders (SVP and above category) have joined Intellect in the last 12 months, with 7 leaders in Q3FY26

- Manish Maakan has been elevated to Executive President & Group Chief Revenue Officer (GCRO). Manish will continue to serve as CEO – Intellect Wholesale Banking

Q3FY26 – Financial Highlights

Income:

- Total income for Q3 FY 26 stood at INR 753 Cr as against INR 621 Cr in Q3 FY25

Platform, License and AMC Revenue:

- Platform revenue is INR 155 Cr as against INR 50 Cr in Q3 FY25

- License revenue is INR 93 Cr as against INR 118 Cr in Q3 FY25

- AMC revenue is INR 143 Cr as against INR 124 Cr in Q3 FY25

- License-linked revenue (License + Platform + AMC) is INR 391 Cr as against INR 292 Cr in Q3 FY25

EBITDA and PAT

- EBITDA is INR 122 Cr as against INR 134 Cr in Q3 FY25

- Profit After Tax is INR 28 Cr after considering exceptional item on gratuity for INR 31 Cr pursuant to new labour codes as against INR 70 Cr in Q3 FY25

Collections

- Collections for Q3FY26 are INR 913 Cr as against INR 553 Cr in Q3 FY25

- Cash and Cash equivalents are INR 1198 Cr as against INR 804 Cr in Q3 FY25

Deal Wins and Digital Transformations

- eMACH.ai accelerates growth with 9 new customers choosing Intellect for their digital transformation journey

- 29 global financial institutions have transformed their digital journey (Go-Live) on Intellect platforms

III. Management Commentary

Arun Jain, Chairman and Managing Director, Intellect Design Arena Limited, said, “Crossing ₹3,000 crore in Last Twelve Months revenue, expanding EBITDA by 33% year-on-year and cash reserves at ₹1,198 crore marks a defining moment in Intellect business design algorithm. We have 3 sustainable & growth businesses in the form of wholesale banking, consumer banking and IntellectAI to capture three opportunity trends. Mainframe tech stack to cloud using eMACH.ai, composable wholesale & wealth management, and large potential of AI using Business Impact AI platform – Purple Fabric. We are currently deepening investments in AI and capacity-building, embedding AI-First principles across architecture, talent, and delivery, to unlock sustainable value creation globally.”

IV. Board Announcement

Appointment of Mr. D. Shivakumar as Additional Director (Independent Director)

The Board of Directors has approved the appointment of Mr. D. Shivakumar as an Additional Director, designated as an Independent Director, on the recommendation of the Nomination, Remuneration and Compensation Committee (NRCC). His appointment is for a term of five years, subject to the approval of the shareholders through a postal ballot by way of a Special Resolution.

III. Management Commentary

Mr. D. Shivakumar is a seasoned business leader with extensive experience across Indian and multinational organisations. He is currently an Operating Partner at Advent International, a global private equity firm. Previously, he served as Group Executive President – Corporate Strategy at the Aditya Birla Group, Chairperson and CEO of PepsiCo India, and CEO for Emerging Markets at Nokia, where he played a key role in building the brand into one of India’s most trusted names. Mr. Shivakumar is an alumnus of IIT Madras, IIM Calcutta, and The Wharton School of Business, and has held several board and advisory roles across leading institutions

V. eMACH.ai Redefines Financial Transformation with AI-Led Agility and Growth

eMACH.ai, the world’s most comprehensive, composable and intelligent open finance platform, continues to strengthen its leadership as the preferred platform for AI-led enterprise modernisation, expanding across major global markets this quarter. Built on 700 microservices, 3,061 APIs and 942 pre-integrated events, the platform delivers unmatched agility, interoperability and speed of innovation.

Transforming Global Financial Enterprises through eMACH.ai

With 8 strategic eMACH.ai-led deal wins, including 3 Destiny Deals, Intellect strengthened its presence in key markets, where focused leadership and customer engagements are driving accelerated growth. These achievements reaffirm Intellect’s position as a trusted transformation partner to global financial institutions.

Destiny Deals

- As Intellect furthers its global expansion by bringing the world’s only AI-first payments platform to the US market, a top-3 Nordic bank has selected eMACH.ai Payments to modernise payments processing and enhance digital payments capabilities across its UK banking operations.

- A valued customer of Intellect Custody since 2008 chose to upgrade their legacy Custody platform to eMACH.ai Custody to modernise operations. The solution combines the robust eMACH.ai Custody base product with the customisations built over the last 17 years in their legacy system, seamlessly integrated along with additional customisations as per their business priorities and client servicing needs. This ensures business continuity while equipping them with a modern, scalable, and future-ready Custody platform. eMACH.ai Custody will also be deployed in AWS in cloud native model utilising the best services of AWS to bring in scalability and resilience.

- One of Sri Lanka’s leading banks, has selected eMACH.ai Cash Management and Supply Chain Finance to modernise its wholesale banking operations and deliver a unified digital experience for its corporate and SME clientele.

Other Significant Deals

- A leading technology solution provider has selected the eMACH.ai Core Banking as its preferred core banking solution to support the digital transformation initiatives of its banking customers. This partnership strengthens Intellect’s partner-led growth strategy and expands the reach of eMACH.ai Core Banking across new client engagements and markets.

- The world’s leading Islamic Bank, headquartered in Dubai selected eMACH.ai Lending to enhance its digital lending capabilities and incorporate Shariah principles across all practices in the UAE.

- The fastest growing bank as well as one of the most profitable banks within the Sultanate of Oman selected eMACH.ai Lending to expand and extend their credit experiences.

- A leading financial institution in the Middle East with over 50 years of banking expertise has selected eMACH.ai Treasury to modernise its treasury infrastructure. The solution will drive operational excellence by unifying liquidity views, enabling real-time decision-making, and streamlining cross-border treasury functions.

- A top-10 bank in the GCC has selected eMACH.ai Trade & Supply Chain Finance to modernise transaction banking and introduce new digital trade/SCF capabilities.

VI. Purple Fabric Unlocks Scale with Strategic Launches and Growing Deal Pipeline

Intellect continued to accelerate the global adoption of its Open Business Impact AI platform, Purple Fabric, designed to make enterprises truly AI Native. Built on an enterprise-grade technology stack, Purple Fabric empowers organisations to reimagine operations, customer experience, products, and compliance through Design Thinking for AI-First Enterprises.

Purple Fabric Accelerates Global AI Footprint Through Strategic Ecosystem Expansion

Purple Fabric has onboarded 14 Value Discovery Partners across India, Africa, Europe, the UK, APAC, and Canada, to accelerate AI-First value discovery and enterprise adoption of Purple Fabric, its enterprise-grade Business Impact AI platform. As financial institutions worldwide face the challenge of moving Generative AI initiatives from “pilot mode” to production-grade “business impact,” this new partner ecosystem will play a pivotal role in bridging the gap. The Purple Fabric Value Discovery Partnership Program is anchored on deep technical and strategic collaboration. Partners are not positioned as distributors but as co-creators within the ecosystem, working closely with Intellect to:

- Co-Build: Jointly develop new AI agents and industry-specific workflows.

- Co-Exist: Seamlessly integrate Purple Fabric’s Digital Experts into existing legacy and core architectures.

- Build: Create bespoke IP and differentiated solutions on top of the Purple Fabric foundation.

Transforming Enterprises through Business Impact AI – Purple Fabric Wins and Digital Transformations Accelerate Global Impact: This quarter, Purple Fabric accelerated enterprise-scale AI adoption with 1 Destiny Deal and 3 successful digital transformations, translating AI investments into faster decisioning, improved operational efficiency, and stronger compliance intelligence. Together, these milestones reaffirm Purple Fabric’s position as the Business Impact AI platform of choice, empowering organisations to lead with intelligence, speed, and trust

Destiny Deal

- A US based specialised mutual insurance company that provides property and business interruption insurance to the nuclear energy industry, will leverage Purple Fabric powered Magic Submission, Xponent Underwriting Workbench, Risk Analyst, Xponent, Claims Workbench, Xponent Data Warehouse solutions for their insurance operations.

Time Magazine recognises Intellect CMD Arun Jain as a “Growth Architect,” validating Intellect’s Design Thinking DNA and its leadership in the global seismic shift toward Business-Impact AI

The recognition of Arun Jain, Chairman and Managing Director of Intellect Design Arena, by Time Magazine marks a definitive transition from digital scale to measurable business outcomes, positioning the company as a “Growth Architect” that builds for long-term value rather than quarterly cycles. The article spotlights Purple Fabric as the world’s first open business-impact AI platform, specifically engineered to move AI from experimental pilots into high-stakes production. From utilising Enterprise Knowledge Garden to curate tacit and explicit institutional wisdom, Intellect has moved beyond the “patchwork” approach of layering technology on legacy systems. This recognition underscores a core thesis, that AI must extend human intelligence rather than replace it, validating Intellect’s strategy of embedding decision-grade intelligence into the operating reality of the world’s largest financial institutions.

VII. Leadership Position Endorsed by Market Leading Analyst

eMACH.ai has been acknowledged as a transformative Open Finance Platform by the industry. Significant accolades include:

Intellect Won Gold Medal in Datos Impact Awards for Banking Innovation – eMACH.ai Transaction Limits Management (TLM) solution has been awarded the Gold medal for Best Innovation in Operational Efficiency in the Datos Insights Impact Awards in Commercial Banking & Payments. Datos Insights recognised Intellect for our TLM platform’s capacity to transform how banks process high-value and instant payments across complex corporate structures.

Intellect Named World’s Best Transaction Banking Software Provider 2025 by Euromoney – Intellect has been recognised by Euromoney as the World’s Best Transaction Banking Software Provider 2025, winning a landmark triple win that also includes Best in Cash Management and Best Corporate Channels. This global recognition affirms Intellect’s position as the world’s leading technology partner for wholesale banking.

Chartis

- In the Chartis RiskTech ALM Solutions 2025 Report, Intellect received multiple recognitions across its Treasury portfolio. Hedging and Risk Management Solutions were rated Best of Breed, LRM and FPA were recognised as Category Leaders, FTP and Balance Sheet and Capital Optimisation were positioned as Enterprise Solutions, while ALM Solutions were acknowledged as Point Solutions.

- Separately, in the Chartis RiskTech Regulatory Reporting Solutions 2025 Quadrants, Intellect was recognised as a Leader for its Regulatory Reporting solutions.

Gartner

- eMACH.ai Core Banking was acknowledged as a representative vendor in the Gartner Critical Capabilities Report for Retail Core Banking Systems, Europe, and also acknowledged as a Visionary in the Gartner Magic Quadrant for Retail Core Banking Systems, Europe.

IDC

- Intellect’s Corporate Loan Life Cycle Management system is identified in the “LEADERS” category in IDC MarketScape: Worldwide Corporate Loan Lifecycle Management 2025 Vendor Assessment

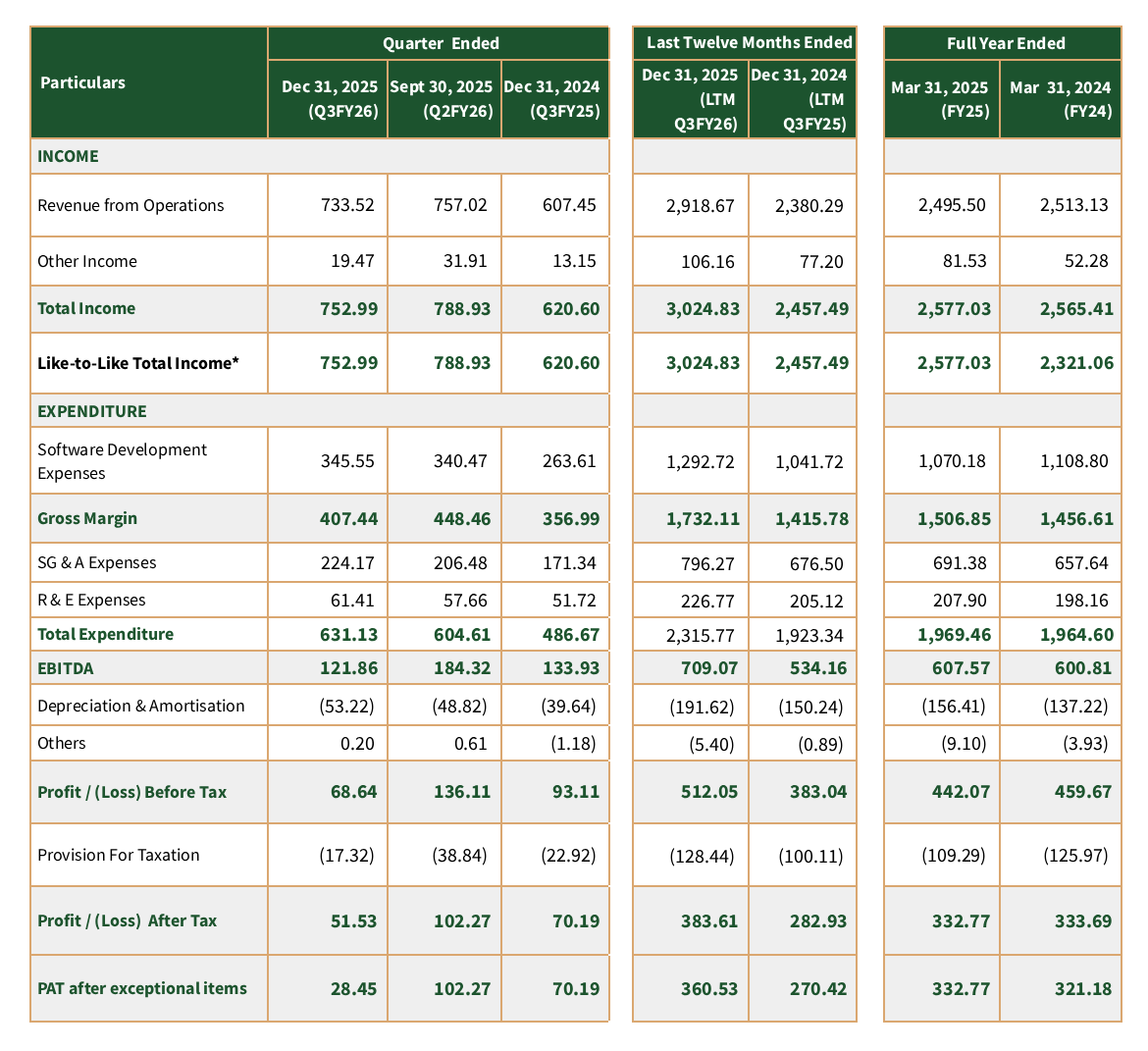

Unaudited Financial Results for the Third Quarter Ended – December 31, 2025

Additional Information on function-wise classification of the statement of Profit and Loss of the Group (Consolidated unaudited)

INR Cr

Note: Exceptional item comprises of

- MAT credit write-off of INR 12.51 Cr in Q4 FY24

- Gratuity Provision of INR 30.84 Cr and the resultant deferred tax of 7.76 Cr in Q3 FY26 (due to new labour codes)

*Excluding GeM Revenue during the contracted period till FY24

Investor Conference Call

The Board of Directors of Intellect Design Arena Limited will meet on Friday, the 30th January 2026 to take on record the financial results of the Company for Q3 FY26 ending 31st December 2025. Intellect will host the Investor Earning Call on the same day i.e. Friday, 30th January 2026 at 5.00pm IST, where the Senior Management of the Company will comment on the Company’s Performance during the 3rd Quarter of FY26 and respond to questions from participants.

Date: 30th January 2026

Time: 05:00 PM – 6.00 PM IST

Topic: ‘Investor Earning Call’ Q3 FY 26 results of Intellect Design Arena Ltd

Please register through the link below to take part in this call.

https://us06web.zoom.us/webinar/register/WN_9l7sigkxQS2EJ_lt0H_75g

After registering, you will receive a confirmation email containing information (including the link) about joining the webinar.

Please Note:

- Please join through this ZOOM Link received by you on registration by 4:55 PM IST on 30th January 2026 for Investors Earning Call

- Request you log in with your Name, Company name and other details while joining the call.

- At the bottom of the window in your Computer/tablet, click the button labelled “Raise Hand “to Speak.

- We shall enable you to discuss with the Management.

- Once your mic has been enabled, unmute yourself and speak.

- After the conversation is over, you will be muted back. If you have any further queries, you can click ‘Raise Hand’ once again.

About Intellect Design Arena Limited

Intellect Design Arena Ltd is a global leader in AI-First, enterprise-grade financial technology, architected from first principles to deliver measurable business impact at scale. With three decades of domain expertise, Intellect delivers composable, intelligent platforms across Wholesale Banking, Consumer Banking, Central Banking, Wealth, Capital Markets, Treasury, Insurance and Digital Technology for Commerce. Applying First Principles Thinking and Design Thinking, Intellect has elementalised financial services into a finite set of Events, Microservices and APIs, enabling faster, modular transformation with predictable and measurable outcomes.

At the heart of this AI-First architecture are eMACH.ai, the world’s most comprehensive, composable and intelligent open finance platform; Purple Fabric, the world’s first Open Business Impact AI platform; and iTurmeric, a composable integration and configuration platform. A pioneer in applying Design Thinking at enterprise scale, Intellect’s 8012 FinTech Design Center – the world’s first Design Center dedicated to Design Thinking principles, underscores its commitment to continuous, outcome-driven innovation. Intellect serves over 500+ customers across 61 countries, supported by a global workforce of domain, solution and technology experts. For more information, visit www.intellectdesign.com.

| For Media related info, please contact: Nachu Nagappan | For Investor related info, please contact:

Praveen Malik |