The reluctance is understandable; a core transformation is no small undertaking. It is relatively expensive and the outcome of such a transformation is not entirely guaranteed. But there’s more to this reluctance. It hinges on two major concerns on the bank’s behalf –

- Fear of rip-and-replace

- Ineffective integration

Banks have a name for technology that replaces the legacy system without interruption of services. They call it a unicorn. It is widely admired and advertised, and people seem to know exactly what it looks like, but nobody has actually seen one. This is why any proposal that involves the core is looked at with a healthy dose of scepticism.

Irrespective of the number of feature functionalities on display, new technology can add value to the bank’s journey only if it allays those two concerns of the bank. It is clear, therefore, that any technology that purports to help a bank on its digital journey cannot do so on the basis of feature functionality alone. It needs to dig deeper; and address the underlying architecture of what it means to be a Digital Bank.

A bank’s digital aspirations might find resonance with some stage of a spectrum. However, whatever the outcome, it must satisfy the principles of the 5E Proposition. Here is what a truly digital bank would look like at the architectural level.

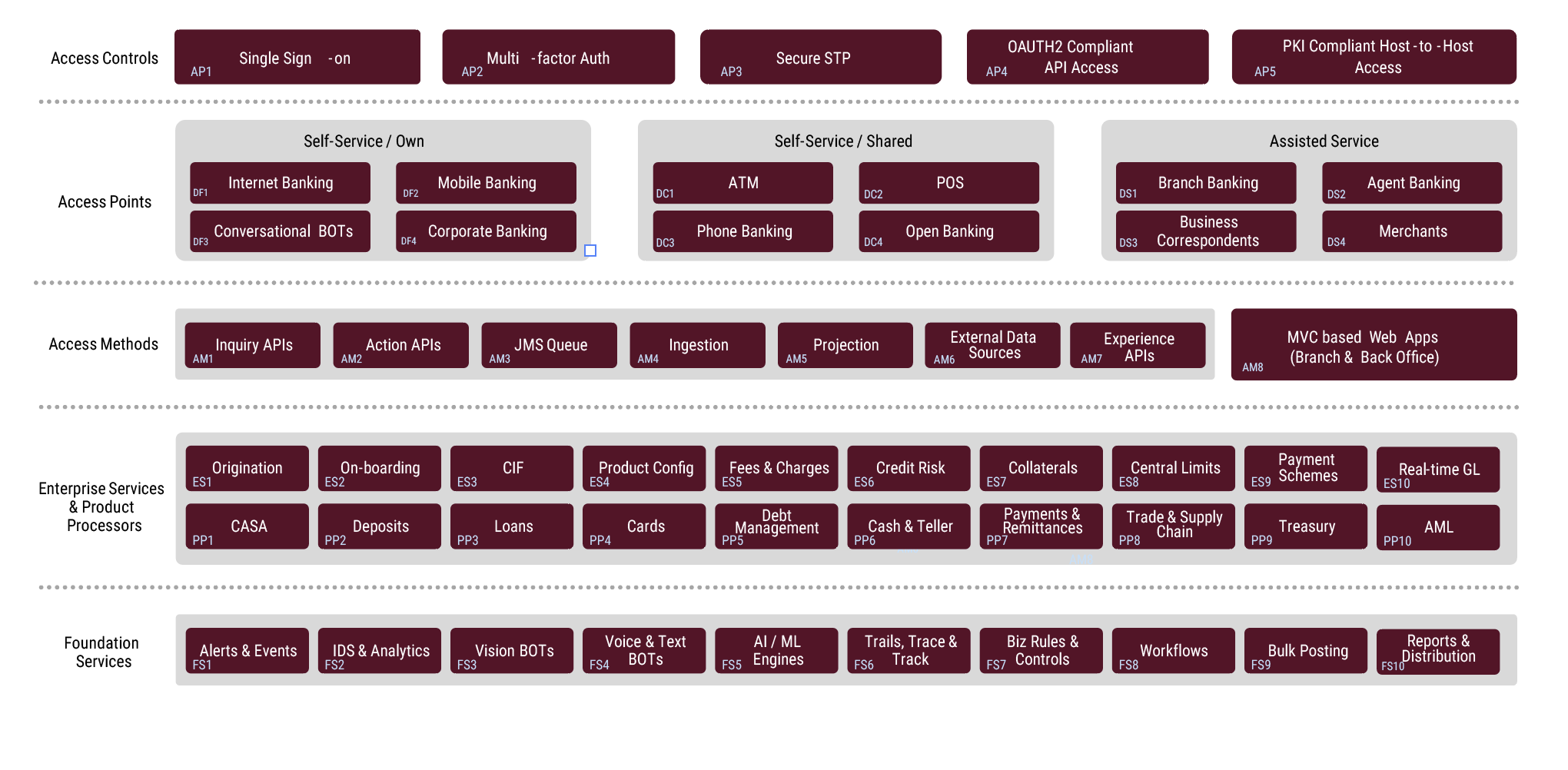

Pop the bonnet: Digital 360 Reference Architecture

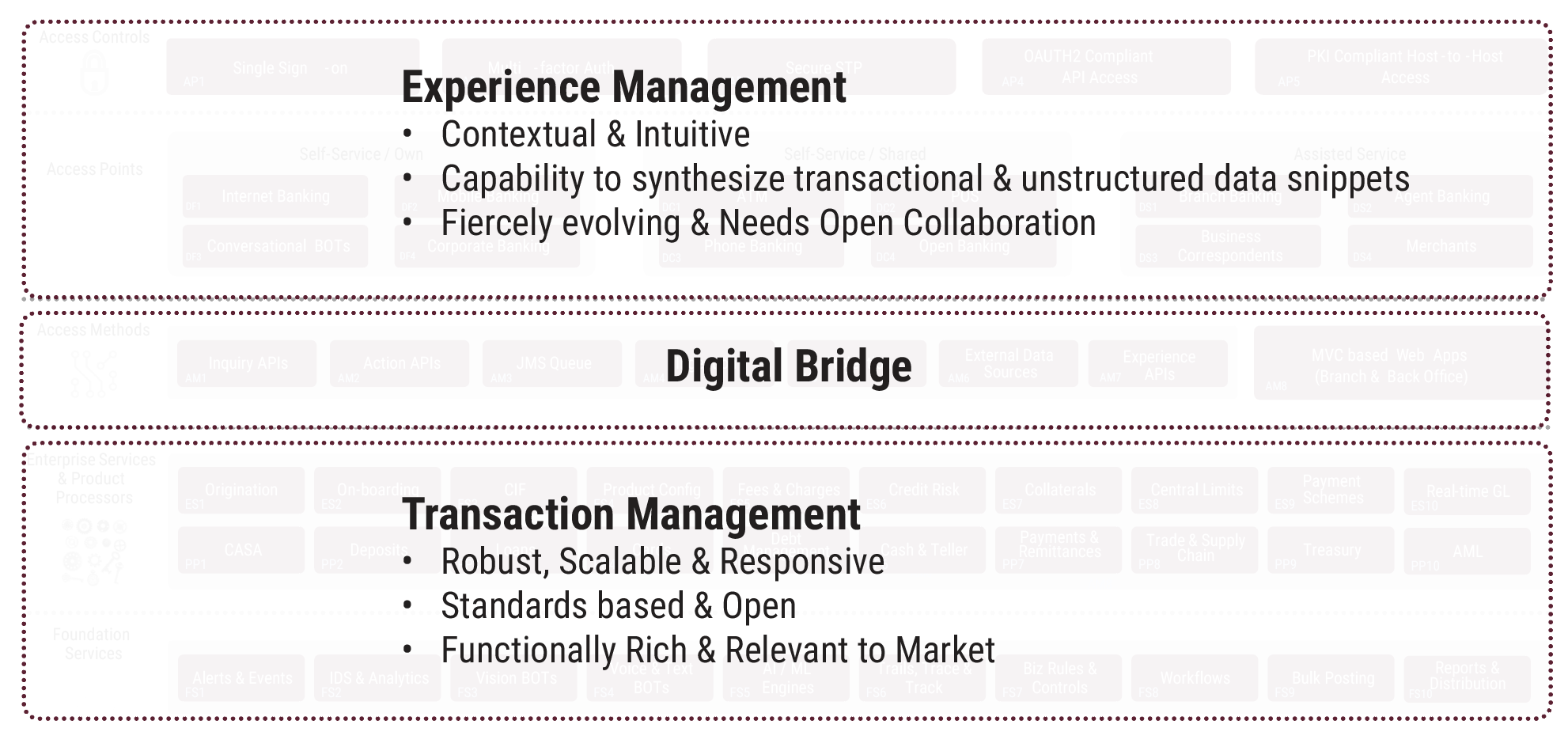

Let’s take a moment to absorb that schema. At first glance, several layers are visible in the architecture. Take a closer look and you will find that there are really only three layers.

Experience Management Layer:

It comprises the top two layers that you see in the schema – access controls and access points. Without getting carried away by functionalities like BOTs or Open Banking, the secret ingredient in this layer is the baked-in self-service protocols. Contextual and intuitive, the experience management layer is capable of synthesising transactional and unstructured data snippets. As an experience layer, it is self-sufficient and does not burden your existing core.

Transaction Management Layer:

This layer consists of your product processors and foundational services. Robust and scalable, the transaction layer is standard based and open. Functionally rich and relevant to market. An important facet of this layer, which as you can see is comprehensive in its product processors, is also highly modular. This means you can choose to turn on or turn off modules as you grow.

Digital Bridge:

The Digital Bridge is a breakthrough in integration. Not just in keeping together internal systems, but in coalescing an entire ecosystem replete with third party Apps. The API-first design makes for a frictionless deployment experience. It is this layer, comprising access methods and enterprise services, that enables flexible product configuration, real-time 360 degree views, and much else.

If a bank had the benefit of such a modular, frictionless, customer focused architecture, decisions about digital transformation would be a rather more straightforward than it is today. The architecture is very much from our time, but it is future proof, and might actually give banks a move surefooted way ahead.