Today’s customer requires a robust, service-driven application that is easily accessible and user friendly, with visibly proactive market rates and pricing services. New digital processes are, thus, key to achieving the scalability and risk management required to meet the near-future’s challenges and opportunities. Banks today understand the need to adopt technologies, which can enhance their ability to analyse past data and predict future trends. To keep pace with customer demands, they are shifting from dependence on unstructured paper data to digital and more constructed data. Digitisation is essential for optimising performance and reducing cost; this is the age of digitised treasury intelligence systems which can provide strategic intelligence to facilitate better decision making.

Today’s customer requires a robust, service-driven application that is easily accessible and user friendly, with visibly proactive market rates and pricing services. New digital processes are, thus, key to achieving the scalability and risk management required to meet the near-future’s challenges and opportunities. Banks today understand the need to adopt technologies, which can enhance their ability to analyse past data and predict future trends. To keep pace with customer demands, they are shifting from dependence on unstructured paper data to digital and more constructed data. Digitisation is essential for optimising performance and reducing cost; this is the age of digitised treasury intelligence systems which can provide strategic intelligence to facilitate better decision making.

Corporates are using digitisation to take their integration with counterparties to the next level and remove friction between themselves and the bank. As a result, corporates can leverage improved connectivity to drive efficiency and eliminate the low-value processes and begin using digitisation to drive business intelligence.

In the critical area of treasury operations, digitisation tools can enable treasury team to achieve extremely high levels of straight through processing (STP). For example, 98% of a bank’s corporate clients’ trades can be auto-matched and cleared. The treasury team would also be able to focus on managing counterparty risk and putting in efficient processes to meet with increasing regulatory measures, such as Basel III.

In the coming years, the main drivers for treasury digitisation will be the need to better leverage big data for risk mitigation and the need to drive operational efficiency across treasury functions

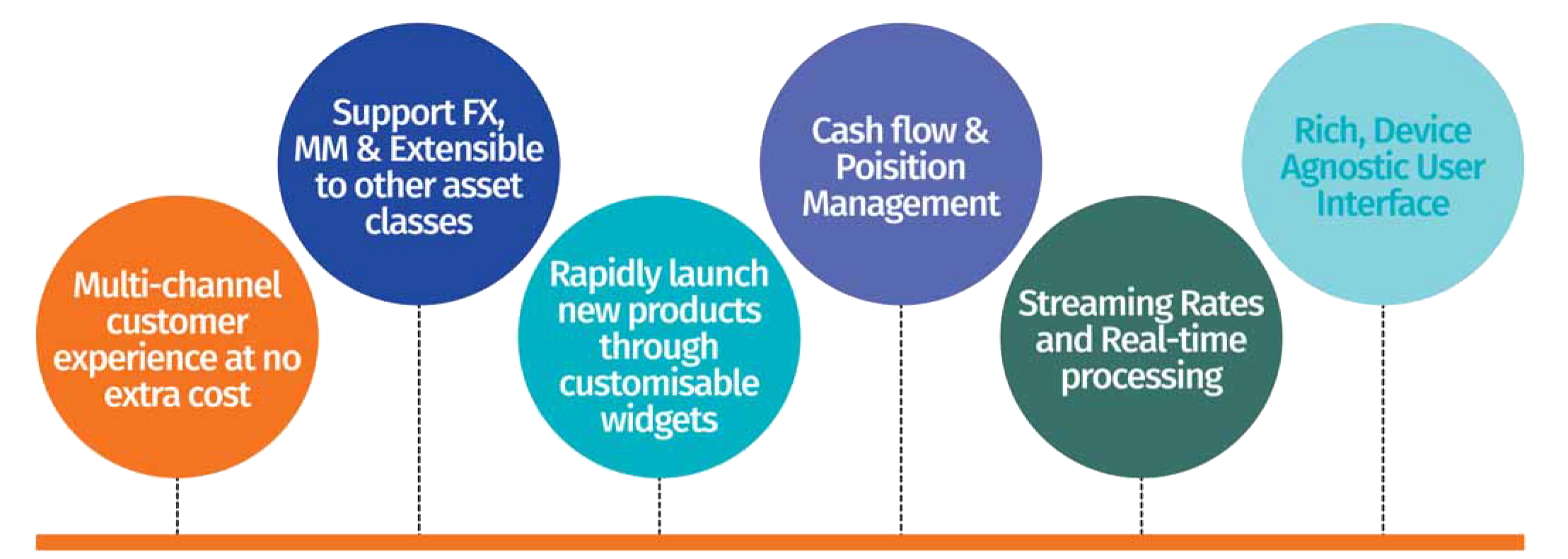

Intellect™ OneTREASURY offers a customer-facing portal solution that has been designed to address the needs of banks’ corporate customers and their retail branches. It addresses the need for a robust, service-driven application that is easily accessible and user-friendly, with visibly proactive market rates and pricing services.

Easy to trade through multi-channels

- Customers can easily initiate FX deals through internet – direct, request for quote and limit orders

- Losing out on attractive strike rates

- Access to streaming market rates

- Access to real-time positions and deal logs not available.

Key challenges faced by the bank:

- Use the existing treasury infrastructure and yet enhance the end-customer experience

- Provide a rich user experience

- Provide extensive entitlement-based access for both customers and sales team.

What Intellect OneTREASURY introduced

A digital, personalised experience for corporate treasury clients of the bank. This was implemented on top of the existing ecosystem which allowed the business to continue as it is, while end customer experience changed entirely. The client has been able to grow business significantly by increasing its corporate customer base to 2,000 clients in 8 months of new product launch. The key features that were brought in:

- Viewing streaming market rates

- Enabling customers to initiate FX deals through internet – direct, request for quote and limit orders. Deal types includes:

- Cash

- Spot

- Tom

- Forward

- Roll spot to time option

- Roll spot to forward

- Online rate negotiation with dealer

- Timer facility for negotiation

- Timer for response and expiry options

- Client has been able to grow business significantly by increasing its corporate customer base to 2,000 clients in 8 months of new product launch.

- Streaming market rates from multiple liquidity providers

- Online rate negotiation with dealer.

Easy to connect real-time with external systems

- Treasury interface – two-way interface – customer spread/ rates & online position updates

- Rate providers – native or industry standard, like FIX/FAST/RET-AD.

Easy to add new functions and products

- Use of smart client-side technology to provide flexible, tailored portal as per client needs

- Component-based architecture and design – supports ease of adding new products and instruments.

Easy to customise reports

- Customer activity dashboard (deals booked offline), audit trail, user entitlements

- Customer and RM reports include: deal log report, deal tickets, order log and client position

- All reports can be downloaded as Excel, PDF and CSV on real-time basis.

Real-use case

A large private bank in India was using a leading trading platform for FX deals as well as a separate treasury back-office solution for settlements. However, the business was not growing as anticipated.

The need of the hour was to deploy a multi-browser compatible, non-applet-based application that could alleviate the client’s trading problems and, at the same time, enable the support activities extended by the bank’s sales team. Enabling the bank’s corporate treasury clients was the key goal

Customer and market feedback:

- Turnaround time to decide and get a deal executed was high

- Dependency on bank branch for negotiation and decision

- Interface to multiple liquidity providers (depending on what the bank has subscribed to)

- Personalised trading – what you can deal on and what rates you can see

- Market alerts and enterprise alerts

- Deal blotter (current trading session) and deal log (including historical deals)

- Very strong entitlement framework

- Entitlements to various roles within the corporate treasury client’s office

- Entitlements to decide which rates are visible to the end clients and for which currency pairs

- Whether view access to buy rate, sale rate or both at a currency pair level

- Dealing access on which currency pairs, buy, sale or both

- Facility of volume ladder and streaming rates based on volume ladder

- Facility of tenor ladder and streaming rates based on tenor ladder

- Personalisation features like theme selection which included colour, font, etc

Performance benchmarking was done with:

- 1,000 concurrent users with access to all standard currency pairs

- 10 transaction requests per second

- 25 rate refresh requests per second.

Key achievements

- Digitising the FX trading process by providing a transparent trading channel to the end customer

- Implementation done on top of existing ecosystem with no disruption

- Removing dependency on branch and thereby increasing the turnaround time

- Audited rate negotiations

- Flexibility to customer to check on multiple rate providers.

For further information: https://irtm.intellectdesign.com/