Prologue:

What could a bank possibly offer that a FinTech cannot? At first, this was a rhetorical question. The FinTechs asked it with a grin, and the banks with a frown. The upstarts were innovating rapidly, engineering more addictive experiences, and delighting customers with rapid response times. The banks, after initially pooh-poohing them, launched a vain effort to match them in their agility. The FinTechs looked poised to take over the financial world and the banks were all but labelled redundant. And then, almost as quickly as the rise of the FinTechs, sense prevailed and the original question – What could a bank possibly offer that a FinTech cannot? – ceased to be redundant.

FinTechs are friends, not foes

The entire prologue took place over a dramatically short period – no more than eight years, the aftermath of the 2008 crash. Not only did it raise harsh questions about the relevance of the banking industry, it also saw the ecosystem spend billions in ill-thought-through technological leaps of faith. The rampant innovation that characterised the Digital Era was never more visible than in these years of banks’ identity crisis.

Three factors have led to a re-evaluation of the rise of FinTechs and the relevance of banks.

- A more mature overall understanding of the start-up phenomenon, particularly the scalability and staying power of promising ideas.

- The essential but stiflingly complex regulatory environment

- The rapid churn of technology, which has opened up new possibilities for banks weighed down by legacy

In the interest of the customer, banks have begun to relinquish their hold over niche lines of business to FinTechs (either their own or as partners), and FinTechs are looking to banks to support them in growing their customer base, scaling operations, and navigating compliance. Banks have begun to approach even departmental digitisation within its ambit, from a more holistic perspective

On this very interesting, collaborative landscape, a new proposition has emerged – unmatched in scope and unbeatable in value. A shift from the scramble of one-upmanship and hyper-verticalization, to a quest for harmonious integration.

This is Digital Banking as it should be!

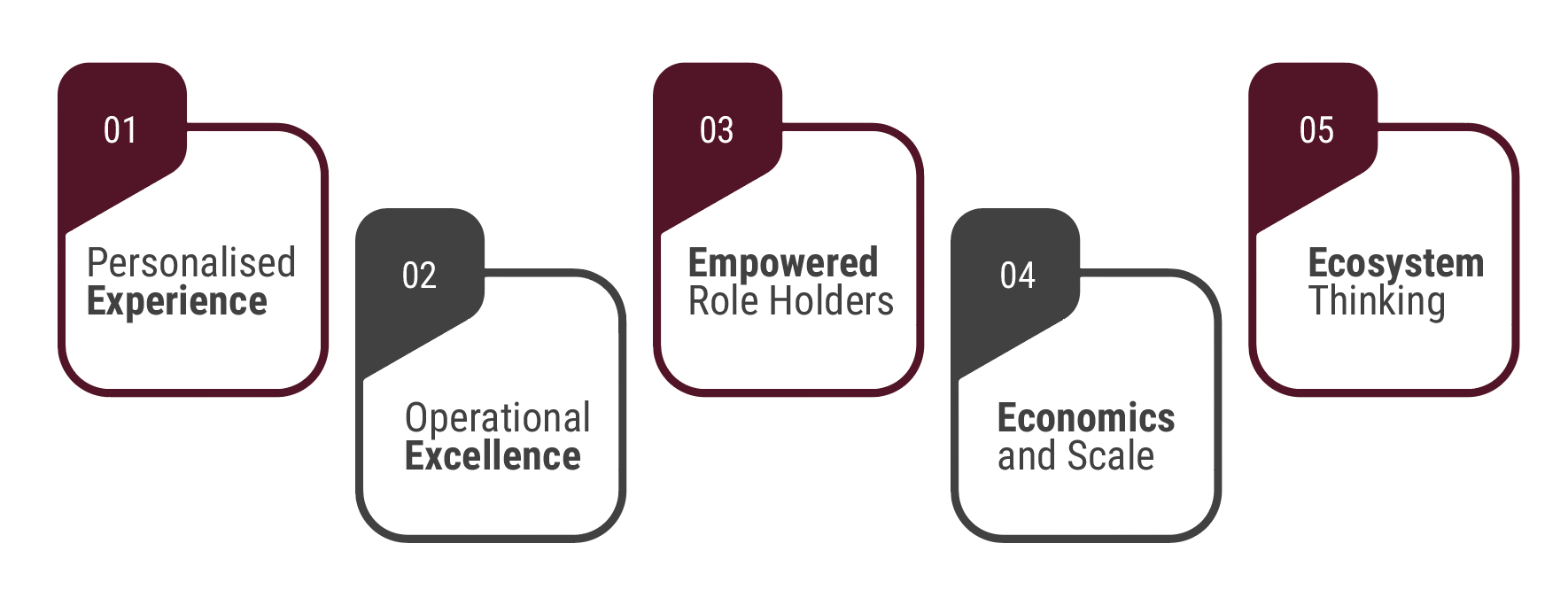

The 5E Proposition

Personalised Experience:We’re smack in the middle of the experience economy. Driven by deep intelligence, we can now elementalize experiences. We can understand the customer not just as an entity but as a person, provide contextual and targeted offers, give them what they actually need. And all this in a manner that is frictionless across channels and devices. Put simply, we’re moving from ‘mass bank’ to the ‘My Bank’ paradigm.

Operational Excellence: If experiences are moving towards customer in the centre, it follows that operations must do the same. Operational Excellence is a re-orientation of architecture with the customer – both internal and external – firmly in the centre. This is the very nature of Lean Banking. Significantly better TAT, and real time everything – real time GL, real time visibility, real time risk management.

Empowered Role Holders: What if self-service could be baked into the system? What if banking were role aware across stakeholders and business functions? When the right tools reach the right hands, a single resource within the bank is able to play multiple roles. Cross-sell and up-sell are organic and smooth. And above all, the bank achieves tremendous business agility – an ability to deploy products in the market proactively, in the blink of an eye.

Economies and Scale:Scale shouldn’t be forced, economy shouldn’t be conditional. A modular, cost-aware architecture allows the bank to switch on or switch off services as it grows or consolidates. An innate adaptability to alternative infrastructure options. The sort of design that can absorb fluctuations in what is demanded of it. And if all the modules – independent and integrated – were sourced from one place? The bank is free to pursue business goals instead of being bogged down by architectural concerns.

Ecosystem Thinking:So far, the bank bore the burden of having to be the source of all innovation. Not anymore. All it needs to do is be able to absorb innovation. Here’s where banking becomes boundary-less. Think open banking protocols, and an API-first architecture. Internally, make all verticalized solutions accessible and integrated on a single platform. And from without, easily integrate with new protocols and have them work in tandem with your existing systems, without rocking the boat. Boundaryless thinking in action. True technological harmony at work.

The 5E proposition moves away from the confines of a product to focusing on the end-to-end experience of the customer, tapping into the data reserves of a bank while achieving the sort of personalisation and agility only believed of a FinTech.

Most interestingly, the 5E proposition is a truly Digital proposition. Customer experience on the outside, and operational efficiency on the inside. We call this Digital 360.

In the next blog, we explore how the 5E Proposition is more than a sum of parts, how it can be baked into the very architecture of your banking system.