The financial crisis of 2008 highlighted the need to address deficiencies in the regulation of financial institutions. Following which, the Dodd-Frank act, Basel III, MiFID etc. and a host of regulations came into force to strengthen the bank’s capital requirements by increasing bank liquidity and decreasing leverage within a bank’s balance sheet. The role of the treasurer has transformed and the treasurer plays an active role in redefining the bank’s business model with the aim of achieving sustainable risk-return objective.

The focus of the treasurer is to collaborate with the bank’s various divisions to strategize the product offering and aid the bank’s customers in hedging their positions better. Client Servicing Platform (CSP) is a tool for the bank’s customers to directly interact with the bank treasury thus enabling them to hedge positions for better risk-return outcomes. This helps the treasurer to grow the bank’s business and generate better spread/fee based income without much exposure to capital needs. CSP integrates the FX flows from various banking businesses that flow into treasury as positions on behalf of the bank’s clients’.

CSP supports hedging products like FX Spots, Forwards, Cross Currency Swaps, Money Markets to cater to funding risk like deposits etc. These products can be bundled and structured to cater to currency risk and interest rate risk management.

Client Servicing Platform (CSP) is a tool for the bank’s customers to directly interact with the bank treasury thus enabling them to hedge positions for better risk-return outcomes. This helps the treasurer to grow the bank’s business and generate better spread/fee

‘Client Servicing Platform’ addresses the need for a robust, service-driven application which is easily accessible and user-friendly, with visibly proactive market rates and pricing services.

Designed to address the e-banking needs of banks’ corporate customers and their retail branches

The customer today requires a robust, service-driven application that is easily accessible and user friendly, with visibly proactive market rates and pricing services. New digital processes are, thus, key to achieving the scalability and risk management required to meet the near-future’s challenges and opportunities.

This service offers customers of the bank a robust, service-driven application that is easily accessible and user-friendly, with visibly proactive market rates and pricing services.

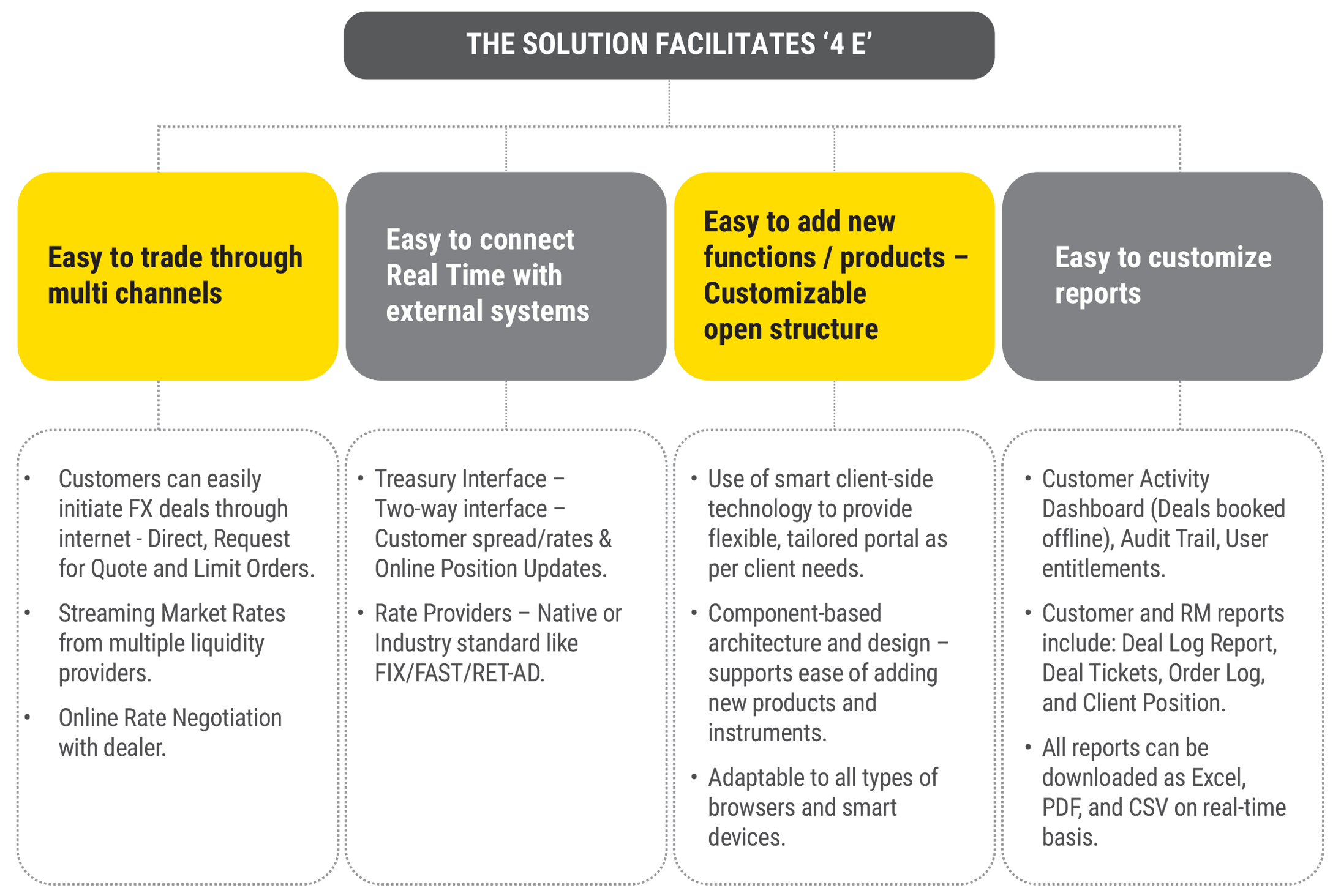

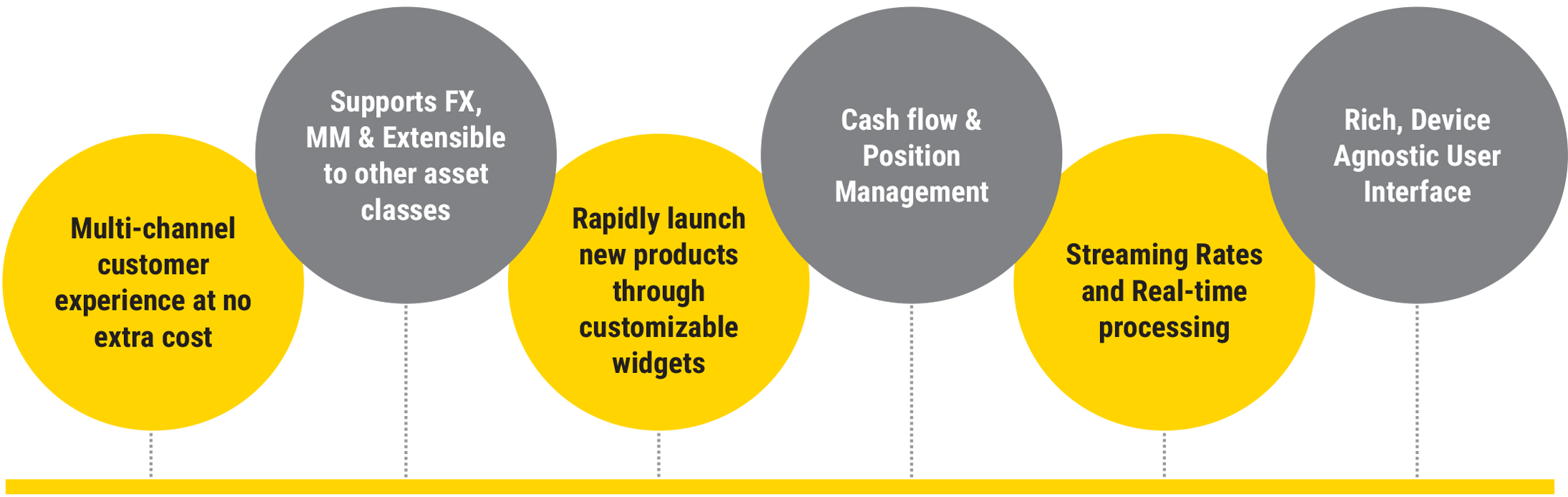

The features of the application are as follows:

- FX Vanilla and Options, Extensible

- Fast Flexible Execution (RFQ, Orders)

- Streaming Rates, Real-time processing

- Rich, Device Agnostic User Interface

- Real-time Market Watch

- Themes

- Charts, News, Alerts

- On-behalf-of entitlement based trading

- Order and Deal Tracking

- Position & Exposure Tracking

- Margin Adjusted Rates & Limit Checks

- Maker –Checker for administrative functions

- Audits & Reports

- Single sign-on

- Third-Party Treasury Back-end

- Provides visual notifications for trading events such as order fills and partial fills, and a notification tray for managing missed notifications.

- Trade blotter gives access to executed trades. Trades are updated in real time, without user interaction.