Launched as a part of iOS 11, ARKit brings three major capabilities of augmented reality to the world: user motion tracking, plane detection, and light estimation. Combined with TrueDepth Camera built into the iPhone X, ARKit promises to be the perfect springboard for wider market adoption of AR.

We see two significant ways in which insurance can be transformed by this development.

Finding Pokemons at Workplaces and Making Them Safer

Conventional workplace safety management involves maintaining registries and conducting a cursory safety audit. This reactive approach has not reduced the risk exposure of insurers, and has consequently not improved loss ratios. Importantly, the number of fatalities have not come down.

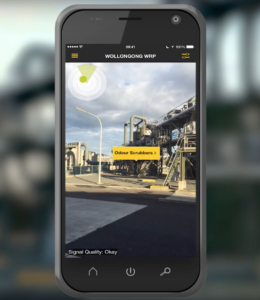

By using AR in a factory environment, equipment and machinery can be overlaid with labels and captions helpful to a worker. The AR object can recall and retain the coordinates and light information of the environment. Few examples include identifying if gas valves are working, the last operated time of industrial machines, last maintenance date, power consumption information, etc.

AR overlays user’s reality with helpful captions and labels.

Image courtesy: The Safety Compass

The combination of IoT devices and AR will help prevent losses, and insurers will have to reduce premium for the proactivity displayed by workplaces. The lowering of premium will be offset by lower expenses in hiring third-party safety auditors and lower claims, leading to a better underwriting profit.

Also read: How IoT, AR and machine learning will transform worker’s compensation?

TrueDepth – not just for Snapchat Stories, For Insurance Claims Too

The current claims process is mired with paperwork and the only technology boost it got was the digitization of forms, and to some extent the use of chatbots in settlements. A far cry from real transformation.

Imagine this – when an insured reports at the first-notice-of-loss, the TrueDepth camera records the facial features with greater accuracy than any camera available in a smartphone today. Within a short period of time, insurers can accumulate a huge volume of high quality training data that can be fed into machine learning. Eventually the training set will make the machine capable of fraud checks.