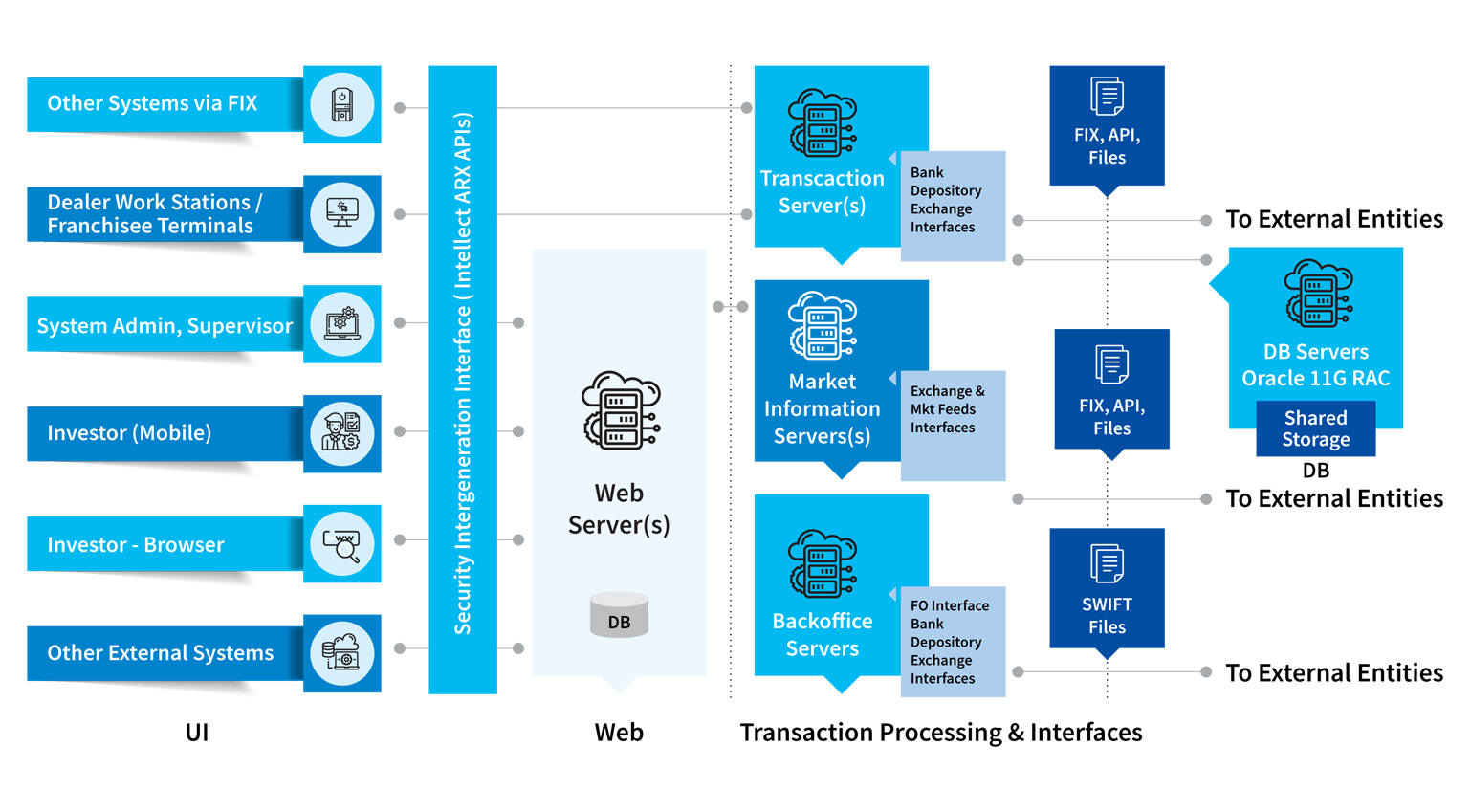

While the need of a brokerage firm is to find seamless synergy across “Digital In” and “Digital Out” experiences, the challenge is to find a unified platform which can support the demands from investors, operations and regulators. Capital Alpha is a “Broker-In-A-Box” solution which provides:

- Omnichannel trading experience for the investor through contextual trading, backed by research and analytics

- Ensured compliance through real-time and integrated pre and post-trade risk management

- Increased efficiency of operations through a comprehensive back-office, combining clearing & settlements, fees & commissions, corporate actions, reports and interfaces to market entities

Clientele

Clientele

We value our clients and are committed to provide

innovative solutions for all their needs.

Highlights

Product Highlights

Multi-asset, multi-market, and multi-currency solution

Capital Alpha provides a multi-asset, multi-market and a multi-currency solution, which allows the brokerage houses to scale up their business, supporting both domestic and cross-border trading for retail and institutional clients.

Flexible Deployment

The product offers flexible deployment options of on-premise, as a managed service offering combining IaaS and SaaS through a hosted infrastructure, or as a SaaS offering through a stock exchange private cloud.

Modular Architecture

Modular and decoupled nature of architecture allows brokerages to easily deploy part of the solution on a need basis, with API-based interfaces to existing IT systems.

Accolades

Accolades

Insights

Insights

Want to know more about Intellect Consumer Banking Products?