Arun Jain, Chairman and Managing Director of Intellect, a pioneer in Design Thinking, in a recent interview with Banking Frontiers magazine, shared his insights on the next wave of transformation that is set to revolutionise the banking industry. Combining cutting-edge technology with design thinking, Arun and his team at Intellect are poised to usher in the future of financial organisations.

Here are the edited excerpts from an interview with Manoj Agrawal, Group Editor of Banking Frontiers magazine:

Manoj Agarwal: What is your understanding of the new wave of technologies such as AI, ML, cloud, IoT, etc?

Arun Jain: The concept of the BankTech (Banking Technology) wave becomes clear when we look at the journey of computers from two perspectives – the hardware side and the usage of hardware/technology. Wave one was mainframes with card machines. Then the major activity of computerisation was record keeping, general ledger and calculations, such as interest calculations. After that minicomputers and terminal desktops started coming in, which is wave two, which was about building applications for branch automation, back-end operations, etc.

Wave three is when products emerge, ie, the applications become technology products. Next came the fourth wave when large banks started moving towards creating a platform, such as an SME platform. For example, banks like HDFC Bank, ICICI Bank, IDFC Bank and Yes Bank started creating a platform based on a bundle of products to solve a particular industry problem. Wave five is coming in today, where the larger banks are moving towards marketplaces, for things like cash management, lending, SME, insurance, etc.

These are five waves on the domain side, and on the banking side. Waves have two sides – one works on usage and the second works on technology. Mainframe was a part of wave one, mini-computer was part of wave two, client-server was part of wave three, distributed computing become part of wave four and cloud computing become part of wave five. These waves are related to each other, they don’t work in isolation.

So what is the business side of the 5th technology wave?

Now because of cloud computing, the marketplace is possible. If there was no cloud computing, the marketplace would not have been possible. The opportunity for banks now is to ride the wave and move towards the marketplace. Most of the banks in India are on wave four. Banks like HDFC Bank and ICICI Bank are moving towards wave five. Some banks are still in wave three. Many of the smaller private banks are in the product space, and they are not even considering converting that into the platform. They’re buying their technology products by product. Various financial organisations are in wave three, wave four or wave five. Decision-makers have to understand where they are in the journey. Domain and technology combination makes it very clear, and they feed each other. Why do I call them waves – because they are not alone, they work in tandem. And one feeds the next. They keep coming one after another and enforcing and reinforcing each other. That’s how the momentum is happening. That is why recognising wave five is critical. The cloud ecosystem has matured and now it is no longer something to try or take a risk.

Many banks, in fact, now have a cloud-first strategy, like they have an AI-first strategy. What are the elements of the 5th wave?

For wave five, we have six elements which are critical and that the bank has to take care of. The first element is architecture. For the marketplace, you need to build the right architecture, in which the elements like data, microservices, events, etc, are separated from each other. The architecture must be very clean and clear, with no overlaps. That is required to connect via APIs and consume what is needed. Only then we can have a true marketplace. A marketplace cannot be created if the separation is not there. The second element is that the microservices have to be well-defined with clear input and output. All the microservices should be available in a vault for the application builder.

The third element is composability, ie, the ability to be able to choose the desired microservices and APIs. For that, what banks need is a composable platform. Our offering in that space is called iTurmeric. The fourth element for the marketplace is embedded AI. AI is absolutely needed in bank operations today. The AI should be embedded in the operations and not sitting separately or remotely, without which it is not possible to have the desired efficiency, real-time hyper automation and real-time decision-making.

The fifth element is data, ie, how you use the data for the entire ecosystem data and the reporting. The sixth element is extensibility. A bank will have some old systems and some new systems. Some will be on-premise and some will be in the cloud. How does the bank use them together, and that is extensibility? In a sense, it is having backward continuity.

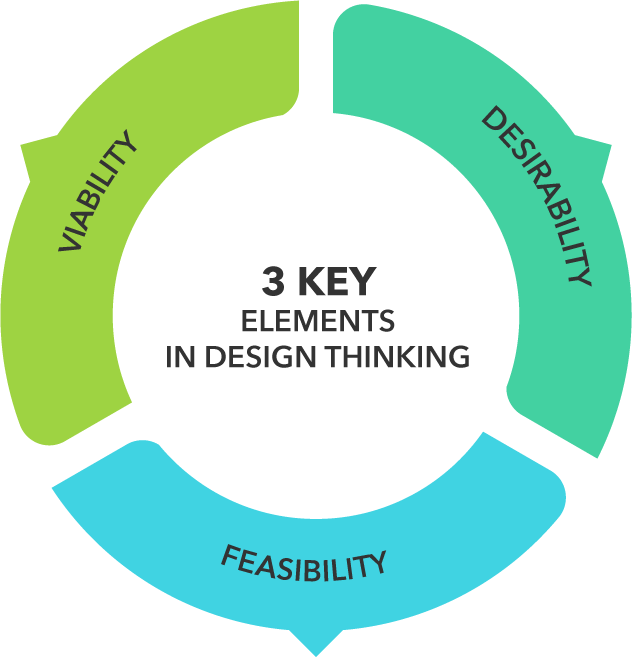

To repeat, what is needed is Architecture, eMACH (Event, microservices, APIs Cloud, Headless), Composability, Intelligence, Data and Extensibility. Design thinking is used as a process to design a bank ecosystem, with a focus on desirability, feasibility, and viability. The goal is to create a clean and clear architecture that allows for the separation of elements and the use of APIs to consume what is needed.

Putting together these functionalities is eMACH.ai. With this, the banks will have the broadest, most comprehensive and most innovative open finance platform to compose their own unique “My Signature Solution”.

Being a global technology company, what are your observations about banks in India and abroad?

I think the change that is happening in the Indian banking system is phenomenal. Indian banks are growing and becoming bigger than European banks in terms of market capitalization. So if you take various banks in Europe, except HSBC, such as Santander, Barclays and other top 10 European banks, Indian banks are bigger than them. HDFC Bank is around $112 billion, ICICI Bank is around $73 billion and Kotak Mahindra Bank is around $42 billion, Santander Bank is around $63 billion, Barclays will be around $33 billion, and Deutsche Bank will be around $26 billion. These figures may be a bit older, but these figures are in that range. What this shows is that European banks are not able to handle the complexity. Indian banks have a great advantage of understanding the Indian market which has 1.3 billion people, but we have 600 districts. Customer profiling changes in every district. Good banks can design the system based on the profiling of the customers. European countries have a few million people- that’s it. For Indian banks, the 600 districts have to be converted to some 30-40 personas which will be there. How do you then service them? For that, they have to have the right technology and catch the right wave and not get caught in products with wave three or wave four technologies, which are fairly static and where products don’t talk to one another. Technologies are changing very rapidly, and the speed of change has increased. AI and cloud both have accelerated the change, it is now 3X. AI is coming from one direction, cloud from another, microservices are coming from the third direction and fintech is coming in from the fourth direction. Now, if you don’t react and respond to the situation, and unless you move towards the platform quickly, you will be stuck with the current approach of spending months on RFP and years on product. Those systems are not going to work out for India.

Coming back to the 5th wave technologies and the marketplace, please describe how you put it together and built it.

We have 1000 people in R&D; we have the largest R&D centre in India for technology. Over the last several years, when we move to intellect, we invested almost 7000 man-years in technology. We start building AI technology in 2017 in our US office, and we didn’t have a lot of people in AI in India at that time. We hired some 20 people in the US, put some 70-80 people in India and created an AI team. We also recruited some people from UK and Europe. Like AI, the cloud was just coming up and was not very stable. Kubernetes was coming yet, containers were there and some new vocabulary was getting created. The Indian teams became more broad-based around 2020. We still have a US team, but the Indian team is the largest.

Okay, so 2017 is when it started, but at the time, what was the design thinking system that you put in place? Since you’re dealing with a lot of new things, how does design thinking actually put all these new things together?

There are 3 key elements in design thinking – desirability, feasibility and viability. We understood the desirability in  the bank would create positivity for them. We know the cloud is a great technology, but how to make it feasible? For that, we need to understand the security of the cloud technology, understand the CPU usage on the cloud, and how the domain will fit into the cloud technology. So that’s the feasibility side. Then we need to make it viable – that cloud technology should not consume more horsepower than on-premises technology, because ultimately we have to save money for the customer. The viability and response time could be appropriate, because some functions in cloud technology may be more inefficient than on-premise technology. So, we undertook the design thinking journey according to these three elements. It took us two years to do it, from 2017 to 2019. From 2019 onwards, we started applying this in various domains – retail banking, corporate banking, insurance and wealth. We started with the cloud, then with micro-services and then embedding AI. We started selling in Europe and getting acceptance. We won a very large deal in Germany, which was a delightful moment for us. It was a special moment for us which showed that our design thinking is working. Then a very large fund in Norway chose us – it is a $1.3 trillion fund. They were looking for ESG compliance for which they needed an AI, and that AI has to be certified by someone. They invited 10-15 vendors, and we got selected for that.

the bank would create positivity for them. We know the cloud is a great technology, but how to make it feasible? For that, we need to understand the security of the cloud technology, understand the CPU usage on the cloud, and how the domain will fit into the cloud technology. So that’s the feasibility side. Then we need to make it viable – that cloud technology should not consume more horsepower than on-premises technology, because ultimately we have to save money for the customer. The viability and response time could be appropriate, because some functions in cloud technology may be more inefficient than on-premise technology. So, we undertook the design thinking journey according to these three elements. It took us two years to do it, from 2017 to 2019. From 2019 onwards, we started applying this in various domains – retail banking, corporate banking, insurance and wealth. We started with the cloud, then with micro-services and then embedding AI. We started selling in Europe and getting acceptance. We won a very large deal in Germany, which was a delightful moment for us. It was a special moment for us which showed that our design thinking is working. Then a very large fund in Norway chose us – it is a $1.3 trillion fund. They were looking for ESG compliance for which they needed an AI, and that AI has to be certified by someone. They invited 10-15 vendors, and we got selected for that.

Does this indicate that financial services moving more and more towards unstructured data?

What is needed is a balance between structured and unstructured data. We need to convert lots of unstructured data into structured data. Decisions will happen when unstructured data becomes structured data. They have to be ready to pull in data of any kind from anywhere. All sorts of data such as employee sentiments, and customer sentiment, from Twitter, YouTube or wherever. A lot of millennial data.

Do you think the Indian decision-makers evolving in a new kind of direction of thinking?

Few of them – I will not say all of us. Banks like HDFC Bank will pause they do slowly. The ICICI Bank after new leadership has not gone running behind the numbers. Banking is such a difficult business. So people are pausing and thinking and looking at the landscape and learning. They participate, they talk and then they apply. And for that, they need to invest in technology and spend a lot of time in design thinking. Otherwise what happens is that some banker will say give me a supply chain finance product. But the product is only the technology. How to run supply chain finance? Who is the customer? How will they acquire the customer? There are so many such questions. If you don’t pause on those questions, you will not get anywhere.

You have spent decades in technology. Do you think we are at a stage where we need a new definition of technology? What would be your new definition of technology?

We can look at it in two ways – the outer side which is applications or IoT or cloud – where we can see the outcomes. The inner part is the techniques of problem-solving. In technology, we have 3 resources – CPU, memory and disk. So technology is how to organise and optimise these 3 resources. The basics have not changed, whether in a computer or a cloud. So, when building new architectures, we should think in terms of CPU, memory and disk.

How do you see this new technology helping the end customer?

A lot of financial systems are broken. The KYC notices keep coming. Transactions fail periodically. If I face problems, how will the person in the village manage this? Our Mission Samriddhi, a social impact enterprise of Intellect dedicated to holistic human development in India, through the design and development of projects that are sustainable and capable of scale to positively impact the larger population. It works in the villages to understand these challenges. We are working in tribal villages where we work on issues relating to water, food, etc. We have started work in these places and are applying design thinking. It has taken us 3 years to start making the changes. It is a slow journey, but it gives me a lot of personal satisfaction.

In conclusion, Arun Jain’s vision is one of clean and clear architecture, marketplaces, and financial systems that benefit the end customer.

Source:

Banking Frontiers magazine released a 48-page special issue highlighting the first edition of Intellect’s thought leadership about BankTech Wave 5.

Read the magazine by clicking this link