Redefining the landscape of government, corporate & retail operations in the digital age

All products from iDTC have been built with eMACH.ai design principles, thus helping enterprises with agility, flexibility and composability, keeping the customer at the centre.

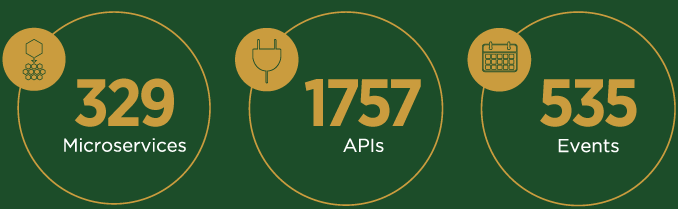

Powered with 329 Microservices, 1757 APIs

and 535 Events, eMACH.ai is the world’s largest and most comprehensive solution powered by the ‘First Principles’ Technology Suite for Technology-suave bankers to design future-ready technology solutions.

This suite

of First Principles Technology keeps a bank’s customer in focus, leveraging the smartness of the Cloud to design the banker’s own composable business impact solutions based on Event-driven architecture, ready-to-use deeply

rich functional Microservices and scores of APIs on Cloud Headless.

About Us

12 Products, 5 Platforms &

4 Exponential Technologies

Customers

enabled FinTech Platform for Global Leaders

Countries

Full Spectrum Banking &

Insurance Technologies

World’s First FinTech Design Center

for Financial Institutions

Webinars

Chairman & Managing Director

Intellect Design Arena Limited

News

Insights

Careers

Our customer-first approach has always driven us to deliver bespoke financial solutions that are backed by the principles of design thinking. In this way, we have fostered a culture of experimentation, exploration, and collaboration to create industry-leading products and solutions that add value to our customers’ journeys, every step of the way.

Learn MoreIntellect

Intellect

Nationalities

Nationalities

Languages

Languages

At the core of our culture is a rich and truly diverse work environment that is bustling with creative energy and individual perspectives.

Learn More

We believe that good design is at the heart

of better business.