We understand that the LIBOR transition is a cross-functional initiative for financial institutions. In consultation with ex-bankers, risk managers, tech specialists, regulators and partners, Intellect brings to you a comprehensive set of services for the LIBOR transition. Intellect Kaurtz RFR Calcservice facilitates fast and secure means of migrating to RFRs (Risk-Free Rates), through the four pillars of:

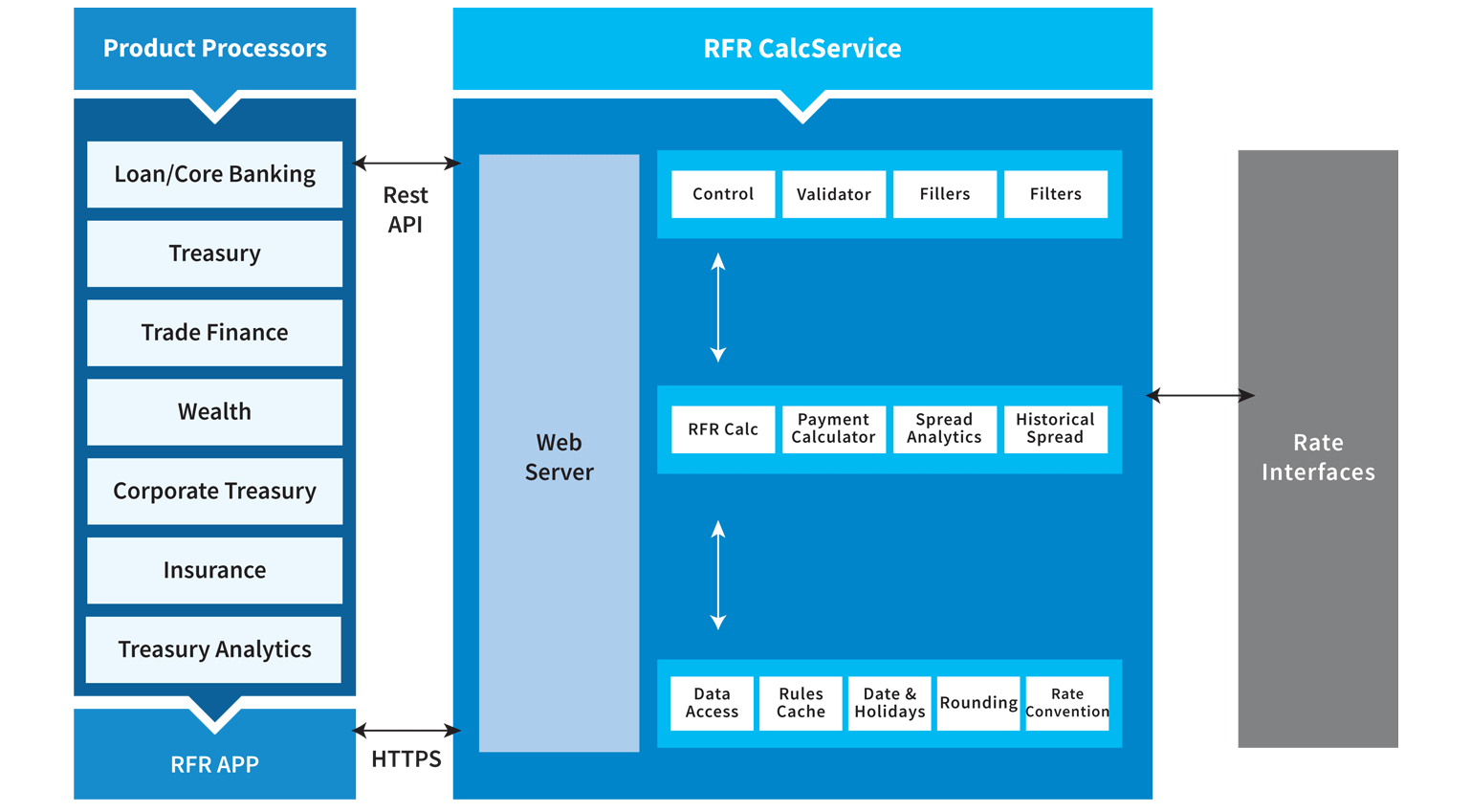

- RFR CalcService: RFR calculator provides financial impact assessment of migrating from LIBOR to RFR, and reforms the rates and disseminates to relevant product processors

- Intelligent Data Extraction (IDX) assists in identification of LIBOR contract-related details and fall back clauses

- Technology Impact assessment and changes to core product processors

- Low-coding interface framework to manage data exchange needs with enterprise data marts and core products, seamlessly

The transition from LIBOR will mean considerable cost and risks for impacted enterprises. The impact would be in terms of changing market risk profiles, changes to risk models, valuation tools, product design and hedging strategies. We can help make a timely difference through a holistic migration approach, covering all aspects of the transition. Intellect provides a non-disruptive implementation through a bolt-on centralised rate engine, bringing in flexibility of operations by supporting multiple variations in calculation of realised rate and accurate determination of benefits/loss through a spread analytics module.

Request DemoHighlights

Product Highlights

Non-disruptive implementation through a bolt-on centralised rate engine.

Comprehensive coverage of the transition process, mitigating the associated risks.

Accurate determination of benefits/loss through a spread analytics module and enabling banks to select the optimal adjustments to the spread.

Reduction in cycle time in contract identification and remediation.

Shortened integration timelines due to easy extensibility.

Insights

Insights

Would you like to know more about Treasury and Capital Markets Solutions?