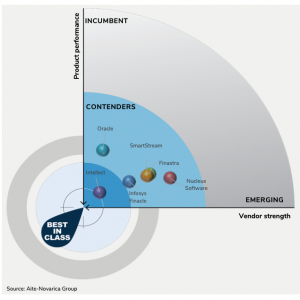

This thorough Aité-Novarica “Impact” report follows an in-depth study of the six leading vendors in this space. iGTB led in three out of four categories

iGTB’s Liquidity Management Solution (LMS) processes 23% of the world’s major currency MNC sweeps, moves over $4 trillion cash annually, handles $35 trillion of notional pool balances, and complies fully with regulations in 57 countries.

London (UK), August 08, 2022: Intellect Global Transaction Banking (iGTB), the transaction banking arm of Intellect Design Arena, a cloud-native, future-ready, new-gen multi-product FinTech company for the world’s leading financial and insurance institutions, has been ranked as ‘Best-in-Class’ and a ‘Leader’ by Aité-Novarica Group. Known for his unparalleled expertise in delivering unique research and insights in financial services, Aité-Novarica’s senior research analyst, Enrico Camerinelli authored this report highlighting key trends in the Liquidity Management Platform (LMP) market and discussing evolving technology to address new market challenges.

The report rates LMS as best-in-class, augmented with an array of tools for the corporate treasurer to deliver fully automated liquidity management across multiple accounts, multiple entities, multiple currencies, multiple geographies, multiple banks, and multiple DDAs. iGTB’s LMS is a 100% cloud native liquidity management platform that includes off-the-shelf core capabilities such as cash sweeping, notional pooling, inter-company lending, investment sweeps, real-time cash control all available with the best client user experience.

LMS is designed with the premise that every dollar of corporate liquidity is a dollar of bank liability. To support this symbiotic relationship between the corporate treasurer and the bank, LMS offers technologies that improve the bank’s balance sheet metrics and, simultaneously, deliver appropriate value to corporate liquidity and deposits. This unique differentiator sets LMS apart from the competition.

Mr Manish Maakan, CEO, iGTB commented, “Liquidity management is a complex domain for banks. They need to meet sophisticated demands of corporate clients -large and small -requiring a real-time solution across multiple geographies in different time zones, while at the same time being faced with legacy, batch-based systems that are resistant to change and have a limited ability to integrate.

Banks have the choice to build solutions themselves or to work with software vendors that invest their own money in creating applications to meet client demands. Increasingly, we see banks choosing the latter route. This is based on the desire to deliver functionality quickly; to reduce risks; and to have fully-fledged applications that are tried-and-tested and in production in diverse countries across the world.

Intellect has a principle of continuous investment. As a result, iGTB’s LMS not only has superb business functionality, but also addresses technology and operational challenges through its contextual and composable architecture. That is why banks that desire stability and consistency choose to partner with us through their digital transformation journeys. This report validates our customers’ trust in iGTB. As the #1 provider of liquidity management solutions to the world’s 100 largest banks, iGTB’s LMS is the gold standard.”

Enrico Camerinelli, Senior Research Analyst, Aité-Novarica and the author of this report said, “Intellect’s position is based on the depth and breadth of its product functionalities, established on its knowledge of liquidity management dynamics, dominance in the field, and client endorsements and references.”

About iGTB

iGTB is the world’s first complete Global Transaction Banking Platform from the house of Intellect. It helps corporate banks prepare for a new era of customer-centric services. With a rich suite of transaction banking products, across DTB, contextual banking CBX, Payments, Liquidity, Trade, and Supply Chain, iGTB is an authority on vertical and integrated products that enable banks to meet their ambition to be the Principal Banker to their corporate customers.

About Intellect Design Arena Limited

Intellect Design Arena Ltd. has the world’s largest cloud-native, API led microservices-based multi-product FinTech platform for the Global leaders in Banking, Insurance and Capital Markets. It offers a full spectrum of banking and insurance technology products through its four lines of businesses – Global Consumer Banking, Global Transaction Banking, Risk, Treasury and Markets, and Insurance. With over 30 years of deep domain expertise, Intellect is the brand that progressive financial institutions rely on for digital transformation initiatives.

Intellect pioneered Design Thinking to create cutting-edge products and solutions for banking and insurance, with design being the company’s key differentiator in enabling digital transformation. FinTech 8012, the world’s first design center for financial technology, reflects Intellect’s commitment to continuous and impactful innovation, addressing the growing need for digital transformation. Intellect serves over 260 customers through offices in 97 countries and with a diverse workforce of solution architects, domain and technology experts in major global financial hubs around the world. For further information on the organisation and its solutions, please visit www.intellectdesign.com.

| For Media related info, please contact:

Nachu Nagappan Intellect Design Arena Ltd Mob: +91 89396 19676 |

For Investor related info, please contact:

Praveen Malik Intellect Design Arena Limited Mob: +91 89397 82837 |